With the official beginning of tax filing season for 2021 now pushed to February 12, this tax season is already starting off more compressed than normal.

If you don’t have an automated tax workflow in place for your 1040 returns, here is an easy way to set one up immediately.

Let’s start with the obvious.

You need a way to see and manage getting 1040s done and out the door by 4/15. Maybe you already use a workflow software that you love. Kudos if you do! But, if you don’t? Setting up an Excel spreadsheet is not the optimal answer. It’s like a putting a screen door on a submarine. Could it work? Potentially….yes. If you don’t plan to go under water.

- Spreadsheets aren’t auto-updated in real time for visibility across users. Theoretically, if you have a master file set to auto-save in OneDrive and send out a link to that master and instructions for every person to be diligent about updates, that could work. If everyone remembers to do it. Every day. And, the human likelihood for that happening is like your submarine with the screen door never going below the surface. When changes are made, if they aren’t auto-saved and kept in a shared OneDrive, who is going to manage the spreadsheet?

- Therein lies another “process” that needs to be created… manually. Who owns the master spreadsheet? Who updates it and how often? Who sends out the updated spreadsheet? When does it get sent out?

- It’s 3:00 in the afternoon and the managing partner wants to see how many of the total returns are complete, in process, unassigned, etc. But, if 6 more returns came in and didn’t get logged in the spreadsheet because someone didn’t have time, what good does that do? How can you be sure the data you are looking at is up to date and correct?

- Tracking questions and client notes in an Excel document is time consuming and inefficient.

- Next year. Despite the obvious inefficiencies of saving, sending, updating, and identifying who is responsible for each part of this manual “workflow,” an Excel file is not the most efficient way to keep track of notes and build a readily accessible history on returns for clients.

- No ‘at a glance’ status dashboard.

Spreadsheets serve many purposes well, but efficient tax return workflow is not one of them.

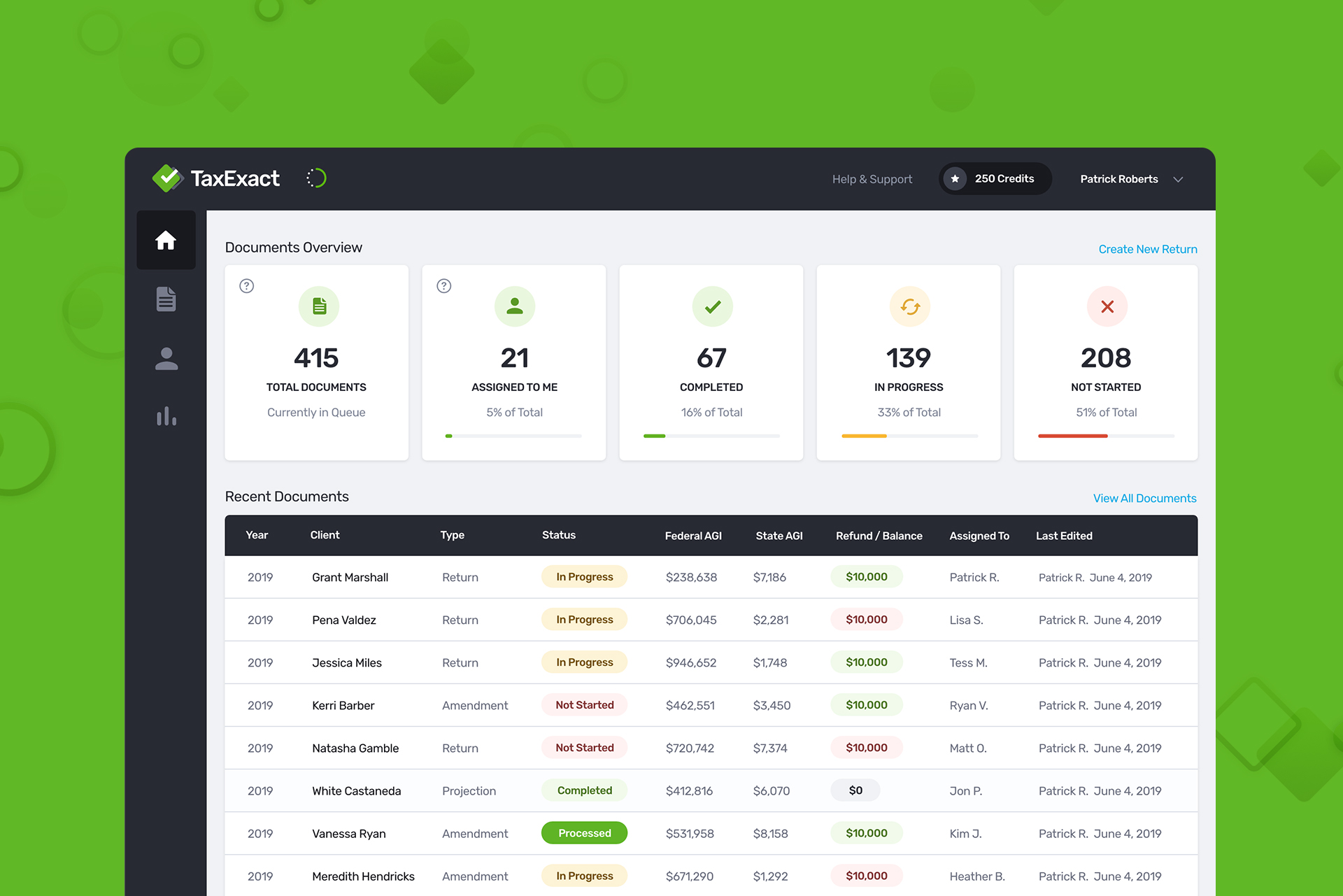

Here is a faster, simpler way to set up your 1040 workflow that will give you visibility real time, from any browser, to the status of all 1040s in the firm. A solution that will allow you to electronically move 1040 returns through the preparation and review process. And, you can set it up in about 10 minutes.

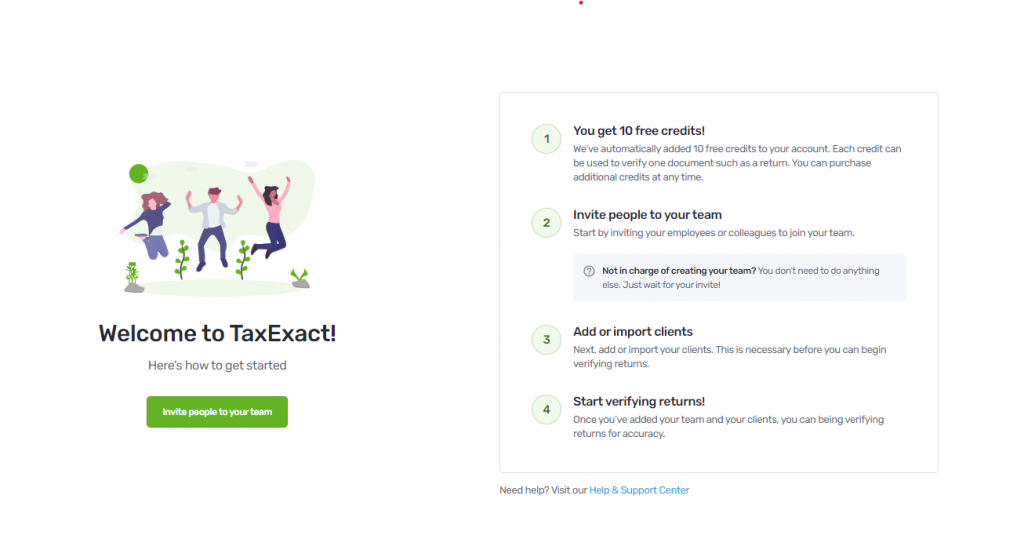

With TaxExact, there is no implementation or training required. Simply go to TaxExact.com, set up an account, and you’re off and running in 3 steps:

- Invite members to your team. These are the folks who will be preparing, reviewing, or processing returns once they are ready to go out the door.

- Import your csv list of clients.

- Start a project- this time of year, a project would be a return. (TaxExact is also used for amendments and projections.)

Once you have a project started, you can re-assign them to preparers, reviewers, or processors. Anytime you re-assign a project, you have the ability to enter notes for the person you are assigning it to. The notes build into an entire audit history record that can be reviewed at any time. Once a return has been approved by a preparation or review level, it can be sent up level for final approval (if required) or moved on for processing. Processors can be assigned returns that are finished, along with notes indicating what to do, for example, “please invoice and upload return to the portal” or whatever your instructions include.

No more emailing Excel files out. No more wondering if the file is “really” accurate or up to date when you’re trying to figure out who’s doing what.

Instead, in less time than it takes to create an Excel spreadsheet that isn’t even an efficient solution, you can set up a TaxExact account, add members to your team and import your clients. You have a real time dashboard that will always give you a pulse on the status of all 1040s you have in house. You have the ability to assign, re-assign, and approve returns (projects), and you can communicate and collaborate via notes as the return moves through the process. Not to mention you have an audit history of notes for each project – all in one place, visible to anyone on the team from anywhere, anytime.

Powerful tool for reviewers

TaxExact also serves as a powerful tool for reviewers, allowing them to verify the results of a 1040 against the tax software itself and reduce the amount of time spent on reviews. A best practice many of our firms use is for the first level reviewer in a firm to create a TaxExact project return from the source documents- independent of what the preparer created in your tax software. When the preparer finishes her return, she re-assigns it to the reviewer. The reviewer then opens the TaxExact summary on one screen and the tax software summary on the other for comparison. Discrepancies and/or errors can be identified immediately vs tediously ticking and tying. Once ready for final review, the partner or final reviewer can skip past all of the data that has been verified, focusing only on the things that need his or her judgement or further discussion with the taxpayer.

Want to know more? Click here to schedule a quick demo and receive an introductory discount code for purchases, as well as your first 10 projects free! You can also check out YouTube channel for more examples of how TaxExact can help your firm this tax season.